11 July 2024: The KSE100 index made an intraday high of 80114, but gave up some of those gains to close at 79,992, still up 151 points for the day. Trading in general remained subdued.

Foreign Corporates were net buyers today of $1.4 million. Foreign Investors so far have not turned into major sellers at PSX.

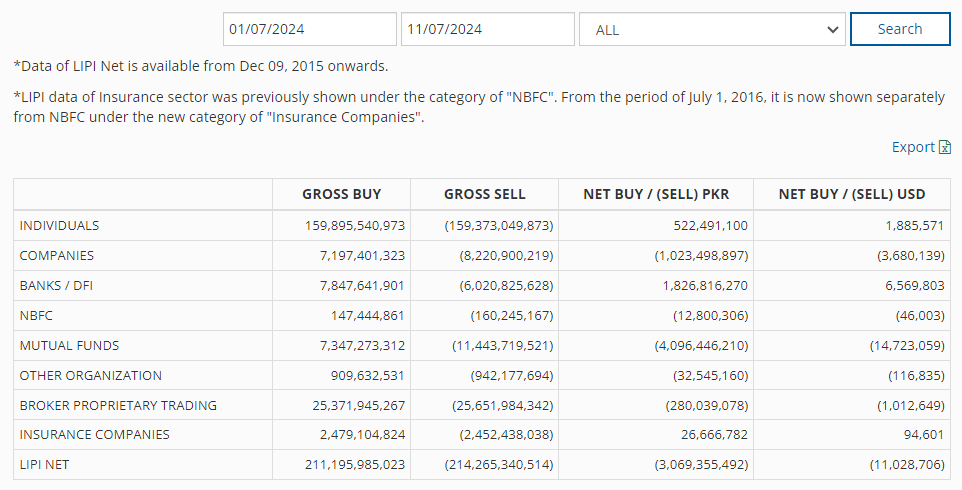

Local Mutual Funds again net seller today of a big amount of $0.98 million. Banks/DFI were also net sellers.

Since first of this month mutual funds have made a net sale of over $14.7 million.

Following are the major Gainers/Losers of the day;

The market is adjusting to the post-budget scenario. A strong upward movement, driven by pre-emptive buying before the new capital gains tax regime took effect on June 30th, has overshadowed the negative assessment of the future economic course following the federal budget announcement.

The increase in petroleum prices and elevated exchange rates, coupled with a strained public finances situation, are choking the economy. It is difficult to hope for further rate cuts in the policy rate as inflation persists. Additionally, the bullish oil prices in the international market further dampen expectations for inflation to decrease.

In this scenario, mutual funds are facing redemption pressure and consistent selling in the market after June 30th. However, the lack of selling by foreign investors is sustaining the market.