After a mildly volatile day, the KSE 100 Index closed at 70,544 up 0.33%, adding 230 points.

PSX had opened after long Eid holidays that had reduced the past week to only two trading sessions.

The whole oil sector rose today, including exploration refineries and distribution companies.

Fauji Foundation companies rose across sectors: food, banking, cement. etc. FCCL rose by 5.8%, AKBL by 5.03% and FFL by 5.02%

This Friday, Pakistan repaid $1bn against euro bonds. This, too, contributed to a positive and bullish feeling.

PSX is in a strong bullish trend and is based on foreign portfolio investment flows. In terms of exchange rate on a replacement cost basis, the listed companies are trading on very low multiples.

Today as well, the FIPI (Foreign Investors Portfolio Investment) was strong. Foreign corporates were net buyers of an higher than normal amount of over $3mn.

Overseas Pakistanis have a negligible contribution to foreign investment flows. Even with a negligible amount, their behavior is erratic. In the last two trading sessions and in this bullish trend, they have generally been net sellers.

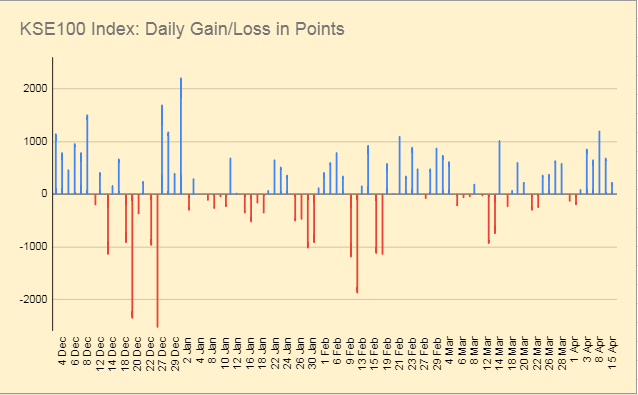

See the chart for the daily gain/loss of KSE100 Index points. Note reduced volatility and days when the index ended in red.